Prepaid metering in domestic PNG

Patranjan Bhattacharya

Patranjan Bhattacharya

The City Gas Distribution (CGD) sector is going to be one of the infrastructure growth engines in India for the next 8-10 years. From about 7 million domestic PNG connections made till the last decade, after the 9th and 10th round authorisations recently, the total number of domestic connections is expected to go beyond 50 million in this decade, a multifold increase over the current base. As more bidding rounds for authorisation are called, this number is going to rise further.

All the PNG connections are metered. The present day installed meters are mostly conventional credit meters and meter readers do a physical meter reading at set frequency. Along with conventional meters come the whole set of operations involving meter reading, bill preparation and distribution, revenue collection and billing-related customer grievance handling. As the number of connections increase, all these operations will become a hugely Opex-intensive job and alternative mechanisms need to be thought of.

That’s where technology comes into the picture; it can help provide solutions to some of the issues being faced by the CGD sector.

Pre-payment as a concept has been there in the domestic LPG gas customer segment for a long time. People have been using bottled LPG gas cylinder since the domestic LPG industry started. This concept further permeated daily life since the mobile revolution began in India, nearly two decades ago, and DTH operators entered the market.

Pre-payment or “pay as you go” system is receiving more and more attention worldwide as different utilities are looking at ways to improve customer service, convenience, cash flow, operational efficiency, and smarter ways of doing things to minimise their risks. Various factors have led to the genesis of pre-payment metering concept in India, keeping in view the benefits that will accrue to all involved in the concept and its acceptance. The concept of pre-paid remains the same, but there is going to be a paradigm shift in the application. It’s altogether a new arena in metering, which is likely to be crucial for revenue management. In the days to come, this will open up new vistas for investment and deployment of infrastructure for better customer services. There will be immense benefits, which the CGDs and citizens of India will reap.

Geographically, prepayment metering has been deployed across the globe. South Africa and UK have deployed this system in huge volumes and with considerable success. Other countries who have adopted the system include Brunei, Oman, Argentina, USA, Poland, New Zealand, Malaysia, Israel, Zimbabwe, Nigeria, Ghana, Kuwait, France, Bangladesh etc.

In India, various electricity utilities in West Bengal, Delhi, UP, Rajasthan, Meghalaya, Manipur, Karnataka, Haryana, Bihar have been using prepaid meters and have been reaping the benefits.

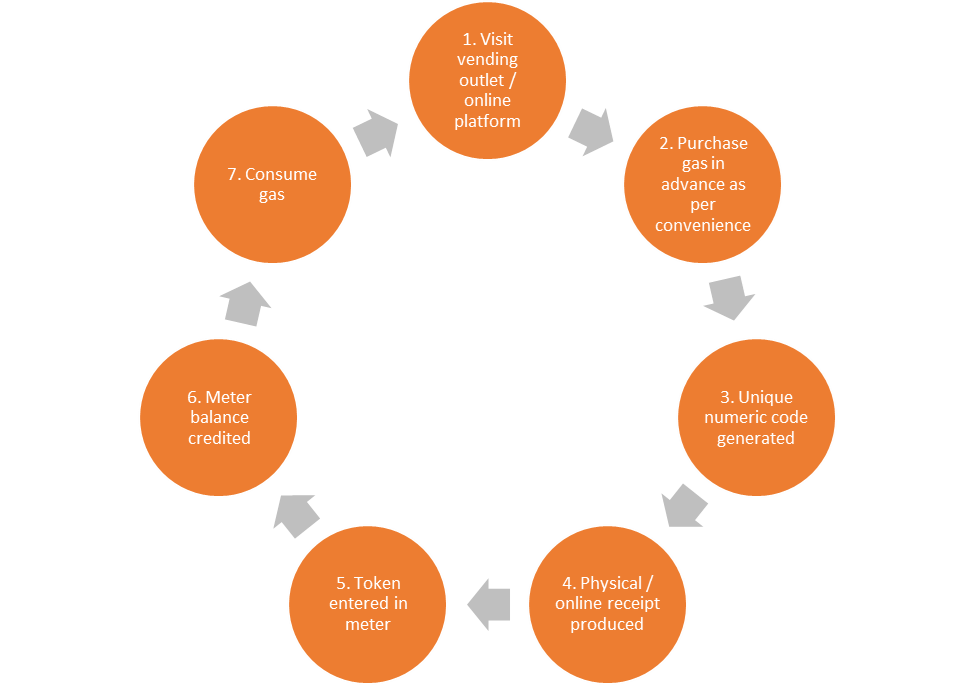

Pre-payment metering system is straightforward. It puts the customer in the driver’s seat for purchasing gas. It’s like filling your bike or car with petrol. You monitor the fuel level and decide when you should refill. Adding money to your account allows you to “refill”. You pay for your gas before it is used.

A new kind of meter is installed in the customer’s house, which has an in-built disconnecting device. The customer buys gas in monetary terms, in advance, by paying through any recharge mechanism. Once the amount is exhausted, the meter automatically disconnects the supply after alarming the customer. Customers can re-connect themselves by buying more gas and recharging the meter.

Historically, the pre-payment metering system dates to over 100 years. GE manufactured the first pre-payment meters in 1899, which were coin operated – a concept similar to the coin operated telephone booths. Technological advancements saw a new generation of pre-payment meters using magnetic cards and then smart cards. The latest generation of pre-payment meters use keypad technology; wherein there is a telephone like keypad on the meter for recharging. With the evolution of communication and technology, customers are also able to interact with the meter through their smartphones.

A pre-paid metering system can bring a world of benefits to both the CGD and the end customer

i. Upfront payment for gas

Gas is paid for before it is consumed. This contrasts with the prevalent practice of credit metering and billing in current CGD practice but is not different from the other segment of pre-paid bottled LPG supply. Cash flow in advance will be a big plus for the CGD.

ii. No unpaid bill

Since the gas is paid for in advance, it eliminates the problem of collection of arrears and unpaid bills; CGDs will not require to put up a team for collection and recovery activities. So, it’s an ideal zero-debt scenario.

iii. Lower overheads

As there is no billing, bill generation and bill distribution, there is a gradual decrease in overheads. CGDs can divert their workforce to other important, value-adding tasks like growing new connections, maintenance, emergency services, etc.

iv. No incorrect bills

Since the gas is paid for in advance, there is no need to generate bills Furthermore, the problem of incorrect billing due to inaccurate meter readings is also eliminated.

v. No disconnection / reconnection

The pre-payment system will naturally remove the CGDs need to get involved into the unpleasant and often difficult task of disconnecting errant customers. This will lead to direct savings in terms of workforce, transportation and legal expenses.

vi. No account queries

A considerable amount of time is often wasted in re-checking meter readings and statements due to customer queries. This requirement is altogether eliminated.

vii. Event detection

With an array of in-built software and hardware in the meter, pre-payment system brings in a host of diagnostics and features, which are absent in a normal credit meter. The meter can log and store events like meter tilt, magnet interference, on-off valve operation, etc.

i. Pay-as-you-go system

It allows the customer to buy gas in advance, as and when required.

ii. Convenience

The system can provide flexibility in making payments through various online and offline methods. Customers will know in advance when they need to recharge their meter and can purchase gas as per their budget, usage, and convenience.

iii. Allows budgeting

The pre-paid system empowers customers to understand the cost of energy and thus enable them to budget their usage according to their financial position and lifestyle. Since it is not required to pay large bills every quarter or month, they may choose their own time and frequency for purchasing gas.

iv. Display of remaining credit

People do not understand complex terms like SCM and MMBTU, and the tariff associated with these terms. But they do understand money. That’s where pre-paid meters can help. They display the actual remaining credit and consumption in money value, and the approximate number of balance days left. This helps customers to manage their gas purchase to suit their requirements. Since the meter displays credit instead of SCM units, it’s easy for customers to co-relate the tariff with their expenditure.

v. No disputes

The pre-payment system gives daily, weekly and monthly consumption information to the customer. Therefore, they are aware of their consumption at any given point in time. A bill doesn’t come to them as a shocker. A continuous flow of information between the CGD and the customer through the meter helps avoid disputes related to consumption and billing.

Any successful implementation of a pre-paid system requires a whole ecosystem that works together to make it successful and reap its benefits to justify economic viability. CGD, customer, regulator and manufacturer are the four pillars and parts of this ecosystem. Pre-payment can give all-round benefits vis-à-vis traditional credit metering when everyone is involved in the process.

i. Social acceptance

Proper marketing and PR campaign can help customers understand the value and benefits of pre-payment. No disconnection at odd times – night or Sundays / holidays would negate the inconvenience caused to customers. Automatic disconnection and reconnection will simplify things for the customers. Customers don’t really appreciate a nasty surprise with their bills; they would rather be happy to pay for what they use. They can budget efficiently using the financial information provided by the meters and buy gas to suit their needs on monthly / weekly / daily basis.

Socially, the concept of pre-payment can be successful if society accepts the system as a whole and thus its introduction should be strategically planned.

ii. Vending infrastructure

The convenience of payment for gas in terms of location and denominations of one’s own choice helps the customer. Pre-paid mobile industry has increased the level of customer expectation for recharging their mobile phones. A mobile phone can be recharged by buying cash cards from multiple outlets which are conveniently located.

Similarly, customers for pre-payment metering system would look forward to buying gas conveniently from several vending outlets.

With the technological advancement, they would also prefer to purchase gas using internet, and mobile phones, and as such an online system, just like the banking system, would be preferred. On the other hand, CGDs would like to have a negligible initial investment in the vending infrastructure and may in turn agree to pay a per transaction fee. This is where the manufacturers come in – they should provide different types of online and offline vending outlets.

iii. System integration

An easy and robust system integration between the manufacturer’s system, CGD systems, and online and retail cash collection would make the system very popular.

iv. Lifetime costs

The pre-payment system, as a whole, is viewed from what it delivers over its entire asset life, and the purchase decisions should not be based on upfront L1 pricing. Accordingly, the system should be cost-effective to facilitate deployment on a large volume. The economic viability comes from reduced operating costs for the CGD, upfront cash collection, better cash flow, reduction in customer complaints, and reduced failure rate of meters. Along with the lifetime cost, CGDs should start asking for products with long term field reliability and should start pushing manufacturers for long terms warranties. These will go a long way in reducing the cost to the CGDs for avoided asset replacement and the Opex associated with it.

v. Regulatory acceptance and push

The regulatory body can play a significant role in facilitating the introduction of these systems. It can ensure that:

At the same time, the regulations can mandate testing of meters at a fixed frequency in the field so that there is push for long term reliability, ultimately leading to reduced cost-to-serve to the CGDs.